Creative professionals, are you saving enough for retirement?

Even if this read does nothing but get you to put a few dollars away I am happy. I woke up this morning, 37 years old, realizing I no longer have a full retirement package from where I worked as a police officer. Panicking, wondering, if I am saving enough for retirement. I have a 3-year-old, a family and about another 20 years of work or more in me. So whats next? The money you earn from working is rewarding, keeping you happy but, understand it will not always be there. You have to plan not only for retirement but, also incidents like last week where I severely sprained my ankle and had to stay off my foot for a couple of days. Sometimes those incidents could be worse!

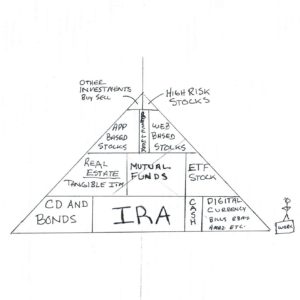

I have always monitored my finances, keeping a pyramid savings plan. So getting older, I have to focus even more on the savings for the future. I want to give you some of my experience with investing, learning how to save all the way from CD’s, stocks, and savings. Check out a few of the tools that I use below. I offer no official financial advice just some of the tools that have worked for me. When investing, understand that there are several risks involved; loss of finances is a potential that you risk when investing in any forum.

Capital One Savings

Higher interest than most

brick and mortar banks.

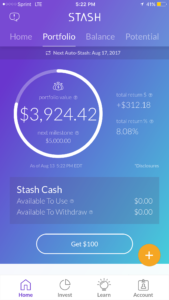

Stash Investing (iPhone/Android) ETF investing which is groups of stock 7% interest currently.

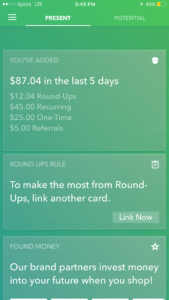

Acorns (iPhone/Android) 4% interest currently.

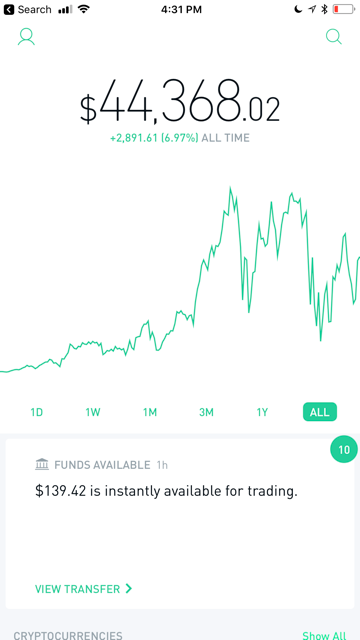

Ameritrade standard web based stock trading. 17% interest currently.

Robinhood Stocks App based, no fees to buy, fees to sell (less than Ameritrade).

Stock trading involves losses and risks.

These are just a few of the services I use to earn more money by making my money work for me. If you have any recommendations I would love to see your recommendations, leave a note in the comments!

I have always been conscientious of my finances, keeping track of credits, payment dates and saving for special purchases. This started back in high school prior to having a job. I would get $20.00 a week for lunch and spending at school. I broke that down into small bills and coins and had a folder I put together for gas, food, motorcycle, misc. Granted $20.00 doesn’t go far as it did then, but it’s still applicable. I would ultimately buy a loaf of bread, lunch meat, and oatmeal cookies. 50 cents for a drink. About $7.00 would get me through the week. Remember I’m 15. I put the rest of the money ($13.00) divided up and by the end of a month, I had about $50.00 saved. After a year I think I had $200.00 saved up. It was pretty impressive! Well the savings; my file folder was a mess, coins and dollars everywhere. 🙂

Fast forward 20 years later and I am still doing the same thing, digitally of course and by using Capitol one 360. It allows creating as many accounts as you’d like to organize your savings to your liking. I’ve been with it since it was INGdirect. Right now I am earning 0.20% interest. Bad, bad but not zero. From there I can create micro deposits daily or weekly to each account for savings. I even have one set up for our little baby. She’s going to need college soon too!

In my life, I have paid off 4 cars, 3 motorcycles earlier than expected. I haven’t owned many vehicles so I’ve kept them for extended periods of time. I have friends that have gone through as many I have had through my lifetime in a years time.

Where to keep your money?

Cash on hand. This is the idlest currency and does nothing for you except be available when you need it. It doesn’t grow or earn interest unless you are purchasing other investments. I keep a minimum amount on hand just in case there’s an emergency purchase. There’s usually less than $500.00 since nearly everywhere takes credit cards. Catch me with cash on me it’s a miracle. Safer this way. Keeping your money in an interest bearing account is the best. Let it work for you! Referring to my pyramid above, not all the eggs in one basket. You’ve heard that repeatedly all your life, it doesn’t change with finances either.

Thinking about physical investments? This could be physical pieces of silver, gold, property, or even sometimes a discontinued item. You might see in my pyramid a sliver between high-risk stocks. This is not fidget spinners, nor is it the next best thing. It generally is a product that has a long history on the market and then the company files bankruptcy or discontinues a product that was extremely popular. Currently, I have a few manual cameras that I am holding. Items that take up very low space and can sell in the future for nearly 2-3x their original cost is a game of chance. Old camera grips and parts are another luck item. This worked well when Nikon stopped consumers from purchasing normal wear and tear parts like grips.

When should I start and how much do I need?

Now! Math is simple. Most of us could spare $10.00 a day. That translates into $100,000 by the time you are 65 at zero percent interest. Add 5 percent and you nearly double your money over that time.You’ll enjoy the calculator I use. I try to lock up about $3,000.00 per year on a CD with a near 1 percent interest. At retirement age I would like to have my pyramid grow wider at the top so that I can earn more, but the risk is higher. I imagine that I will have about 40 percent IRA, 30 percent in real estate, 10 percent in stock long term, 10 percent in cash, 10 percent in other investments. Ultimately when I retire at whatever age, I hope to have $1-2 million saved in the bank. It might be shooting for the moon, but with hard work and good returns you never know where it could take you. You might be surprised but, it will take nearly $500,000-$1.5 million to effectively retire without needing to supplement money. If you are a photographer and you do not pay taxes, start now! Pay into your SSI and this will help you in the long run.

How much should you save?

As much as you can, seriously! Don’t over exert yourself, but if you do need liquid assets then adjust your pyramid to have more short term CD, or high-interest saving accounts. This way you can always have access. Start out with $5.00 per day or $150 a month. If you can afford more, then do it! $150 a month will give you $1800 a year, $54,000 in 30 years. That’s definitely not enough to live off of but creates a pretty nice cash pot. Currently, I am saving $25.00 per day. There are ways to save money too. I will touch on those lightly but it all starts with the home.

Keeping your savings out of sight will help if you’re a habitual spender like I am. Lock them up for 6 months or 1 year and earn 0.5-1% interest. Unfortunately, the cd and savings accounts are really low on interest. It used to be plentiful when I first started in the 3, 4 and 6 percent on some occasions. This is why I have to diversify around between stocks, higher risk and alternative investing like bitcoin. Keep your options and mind open to alternatives but know that this type of investing is extremely risky and rare to make profits.

How to save on expenses.

I have a few steps that will save you in the long run but it takes discipline. I do not have cable tv, just internet. I have been this way since 2004. My mom pays for cable and her bill is around $200+ a month for tv. I personally can’t watch that much tv. I subscribe to Netflix and Hulu and watch some favorite creators on youtube. It’s enough entertainment for me. When I do want to watch a season I head on over to iTunes or find them on Netflix. I’m generally working too much to watch tv. Shop smart, cut back on excessiveness. We bought a freezer recently and Lindsay will get meats and other items that can be frozen either by themselves or with vacuum sealing. We do eat out some times which gets expensive with a 3 yr old and the two of us easy $35.00 a day. So cutting 4 eat-outs a week can net you $100.00 ($140 but you have to eat so prepping your own food still has a cost) Round up savings and piggy banks. Literally. Piggy banks are a way to save about $14-20 a week if you use cash and get lots of change. This can be an effective addition to your cash set aside. Cut on subscription services that you rarely use. Subscribe and Saves, Ring doorbell video subscription or even a membership to some particular location that you might be able to sub out for a home activity like a gym. Turning your air up just 1 degree will also save you a bit of money per month. I have been a habitual “leave it on” where I’d go run out and leave the computer on. Now I have been shutting it down. We’ve also since turned our hot water heater temperature down a bit too. Reducing our electric bill down by about $40.00 a month.